It's a tool...not a solution or method

I hear a lot of people asking this question. Of course it's not always HubSpot they're asking about - it could be Marketo, ActOn or various other marketing automation tools. (When I hear Pardot I groan inwardly - another company that got roped into the high-price, long-term contract for an overly complicated CRM and mediocre marketing automation by the high-pressure sales team....).

Usually it's asked by the management/executive team that approved the spend and experiment - they're not seeing business impacting results. Marketing doesn't ask as often because they're busy - simply implementing and managing marketing automation is labor intensive, and there are vanity metrics to track (and which fairly consistently improve.) So the marketing team is busy, and in their frame of reference, delivering results.

The problem is that management was often oversold on the capabilities of the software. The discussion often sounds like "HubSpot will let us improve our marketing, lead generation, sales close rates and revenue."

Of course that's simply not correct - it's akin to saying "SolidWorks will help us improve our designs" or expecting that a new ERP system will reduce lead times.

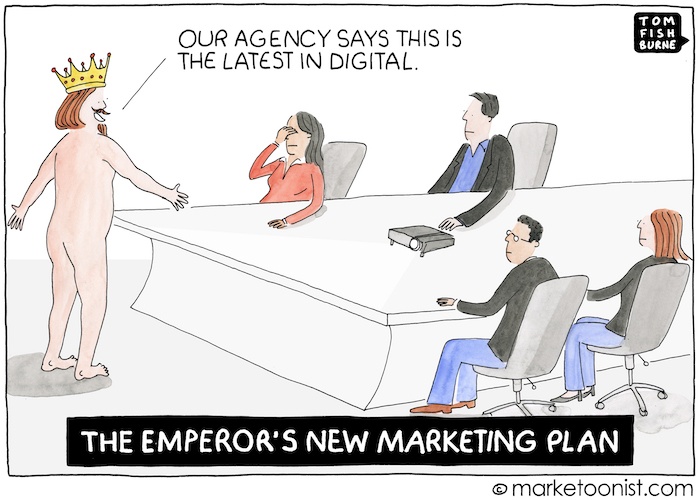

Breakout B2B marketing is an element of modern revenue growth strategy. Both are built solidly on ideas and insights - the gadgets are simply the latest "emperor's new clothes."

Why?

Buying is different

There's a simple reason why industrial manufacturing companies that implement HubSpot sometimes fail to achieve the results they had expected.

Most companies plug their traditional industrial marketing approach into the software and expect it to improve. Adding a blog and some social media doesn't change the fact that buying has changed - and that means it's not HubSpot which is disappointing, but the company's marketing.

Further, the disappointment the company feels at its marketing results is actually just a symptom of the disappointment buyers feel as they thrash around the internet looking for substantive info as they try to solve their problems.

Four statistics capture the essence of the problem.

- only 3% of potential buyers of any given product/service are in the market for it at any given time

- 93% of B2B purchases start with online search

- buyers are 70% of the way to a purchase before they expect to have to speak to a sales rep

- 74% of buyers ultimately select the first vendor that provided value as they tried to understand and solve their problem

And yet the vast majority of industrial marketing continues to yammer on about product features and benefits.

The truth is nobody cares about your product but you. They care about reducing their downtime, improving their quality, increasing customization in short runs, reducing waste, boosting OEE (overall equipment effectiveness,) overcoming workforce challenges, and similar objectives. Imagine sitting in your prospects' engineering and operations staff meetings...now think about the issues they're wrestling with and held accountable for.

Want to be really effective? Think about your customers' customers' staff meetings - if you can understand the issues being discussed there, THAT insight holds the key to industrial marketing success for most B2B companies.

Buyers used to be hostage to asymmetric information - they relied on cold calling sales reps to propose solutions to problems and to provide details about the solutions. Today of course they simply turn to the internet. But only in the final stage do they look for particular solutions. More often they search for a better understanding of the problem - which product related keywords and expositions of features and benefits generally fail to support.

Mindshift first

Before anyone wastes any time or energy worrying about HubSpot (Marketo, Pardot or other software) the important change is in mindset.

Companies must recognize and embrace a world of educated and insightful buyers in which successful industrial marketing is like virtual consulting - helping those buyers become even better educated, more insightful and more effective at their jobs.

It's that simple.

And that means the president/CEO must lead the effort, because in addition to marketing strategy itself, there are implications to sales process, organization resource allocation between marketing and sales, and even the roles of PR and customer service.

Marketing driven initiatives are laudable, but absent engagement with sales, unlikely to impact revenue. (This 10 minute narrated "picture book" lays out the changes which buying behaviors demand of a company's revenue growth function.)

Then process

In dissecting frustrating situations I find that companies that are frustrated with HubSpot and inbound marketing often started by buying the software and inaugurating a blog. About what? Typically the same things they're accustomed to presenting - details of their solutions and corporate profile info. That simply adds fuel to the fire for prospects who are sick of being marketed to.

In dissecting frustrating situations I find that companies that are frustrated with HubSpot and inbound marketing often started by buying the software and inaugurating a blog. About what? Typically the same things they're accustomed to presenting - details of their solutions and corporate profile info. That simply adds fuel to the fire for prospects who are sick of being marketed to.

And they may create some pro-forma personas. They'll sit with the sales department and create fictional characters with cute names which are stylized extrapolations of what sales reps project on prospects. They almost never incorporate third-party, qualitative, interview based insights.

Absent in this are critical connectors - the ligaments that connect corporate strategy to the revenue growth program and the tendons that connect program elements to create a lithe whole as sales & marketing muscles are strengthened. These include:

- understanding of long, medium & short term corporate strategy (why is revenue growth important, how rapid, etc.)

- qualitative buyer research

- context of industry 4.0 changes (IoT, 3D printing, sharing economy)

- product road map

- competitive deep dives

- content creation process

- understanding of sales channels and evolution in industry

- empirical assessment of current and reasonable target states (against a robust maturity model)

- framework for progress on key priorities

- fully integrated editorial calendar (events, content, PR, speaking, etc.)

- best practice, detailed templates for all activities

Here's where it gets tricky. Often boxes can be checked but the outputs are single dimensional.

All of these must incorporate the perspective of P&L management, corporate strategy at a board level, industrial sales and procurement. And yet, when it's handed to a typical B2B marketing department - even one capable by traditional measures - that's missing.

And only then HubSpot and tactics

Only with all those pieces in place does the potential of HubSpot to enable a successful program rise.

Articles will answer important questions - to create early stage leads among the 97% not specifically in the market yet, and establish the 74% edge of expertise among the 3% who are searching.

Substantive content will help prospects self educate as they conduct their own research, and marketing automation will help transition from marketing, through inbound sales to field sales at the prospect's pace.

And data (for what it's worth) will inform decisions along the journey to continuous improvement.

It's complex and it requires a foundation of insight, and then relentless execution. HubSpot's value comes in its centralized tool set and convenience. But it's powered by ideas - and the ideas of traditional industrial marketing are unlikely to achieve much success going forward.

That's precisely the problem the new Manufacturing Revenue Growth program solves. It empowers companies for successful B2B marketing, including an implementation of HubSpot, but builds the foundation of insights and ideas that are critical to success. It's not outsourcing - it's an approach that's comfortable to industrial manufacturers that prefer to build capability.

If you've implemented HubSpot, tried SEO or given blogging a go and find that you're not achieving the results you anticipated, it might be time for a different approach.

In the meantime, does your corporate strategy include any planning for the impact of trends like demographics, IoT, 3D Printing, and Sharing Economy? Middle market manufacturers need to start to plan. This free guide provides a framework and questions to facilitate discussions among executive management teams and independent directors.

In the meantime, does your corporate strategy include any planning for the impact of trends like demographics, IoT, 3D Printing, and Sharing Economy? Middle market manufacturers need to start to plan. This free guide provides a framework and questions to facilitate discussions among executive management teams and independent directors.